Whatever financial market you choose to trade in, you will always need to consider your costs and the price difference between purchasing or selling an underlying asset, also known as the spread. Traders who trade equities will also be familiar with the Bid: Ask spread. The higher the spread, the higher your costs and vice versa.

T4Trade offers both fixed and floating spreads. Whether you are a beginner or a professional trader, you can choose the right spread account for you and explore opportunities with our superb conditions.

There are two kinds of spreads: fixed and floating or flexible. The first are predetermined and are not impacted by market conditions. The latter are flexible and can fluctuate unexpectedly depending on market volatility. Flexible spreads can go high or low, subject to market news and events and as such they can offer opportunities or lead to higher costs.

Fixed spreads do not change over time and allow you to determine the cost of your trading position beforehand. They are stable and pricing is clear from the start. Their cost is usually higher than variable or floating ones.

Floating spreads are usually cheaper, but because they fluctuate so rapidly they are better suited for traders who hold long-term positions. During times when spreads widen, you can protect yourself by limiting the amount of leverage or holding onto a trade until the spread has narrowed. It is up to you to determine which spread type suits you best.

News are one of the main causes of market uncertainty and volatility. Macroeconomic data released on the economic calendar can also impact market conditions, as they can exceed expectations and market consensus or disappoint, creating unexpected volatility. Liquidity providers, like traders themselves, cannot forecast volatility and they try to offset some of their risk by widening spreads.

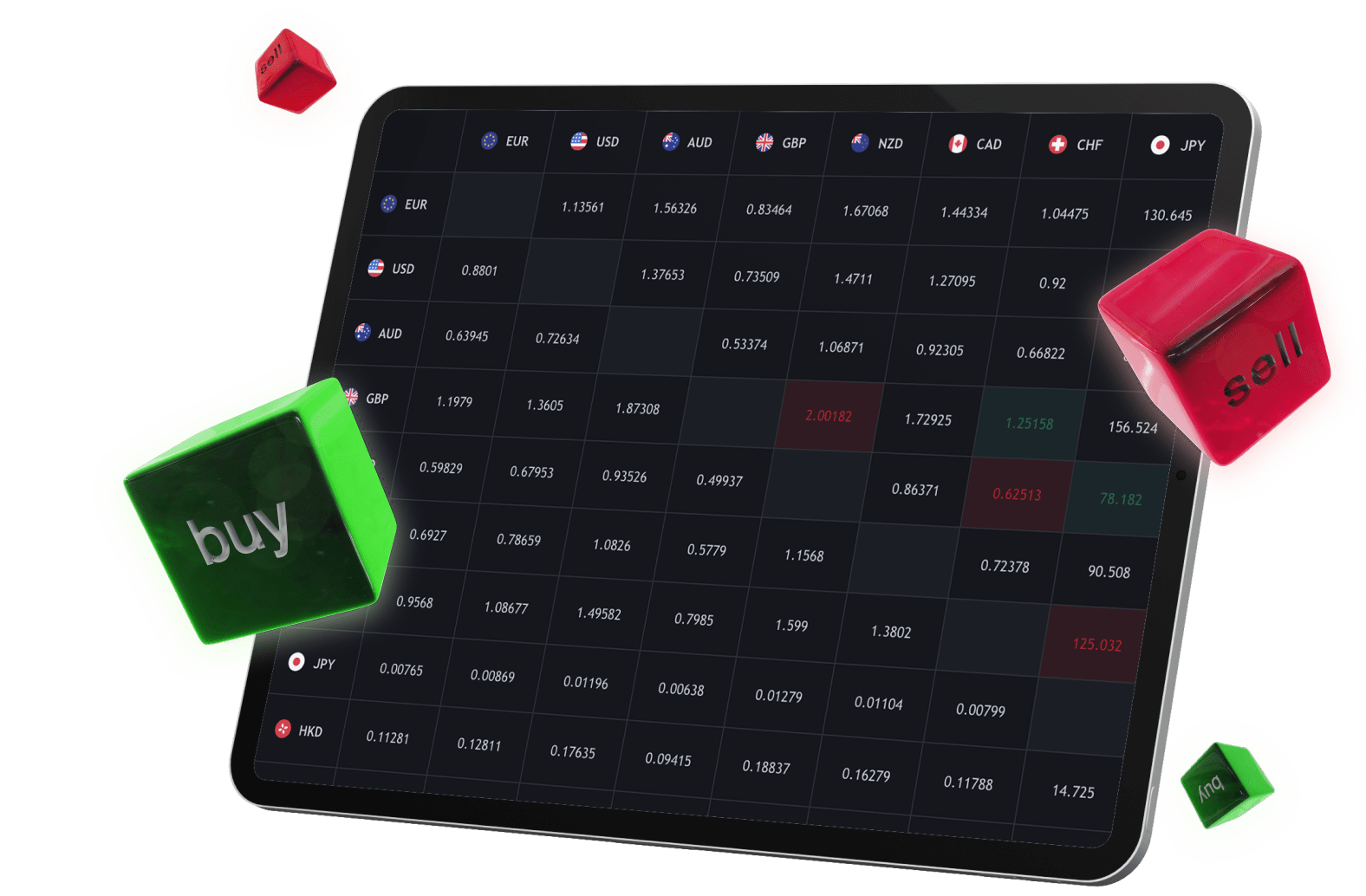

When there is a large difference between the bid and the ask price, then the spread is considered to be high. Major currency pairs usually have low spreads, whereas emerging market currency pairs generally have a high spread. Higher than normal spreads are the result of high volatility or low liquidity. Before crucial news or during important political events such as the US elections, spreads can widen considerably.

When there is a small difference between the bid and the ask price, then we consider the spread to be low. Traders prefer to trade with low spreads usually during the major forex sessions. A low spread means that there is low volatility and high liquidity.

T4Trade, with registered address of F20, 1st Floor, Eden Plaza, Eden Island, Seychelles, is a trade name of Tradeco Limited.

Damadah Holding Limited, with registered address of 365 Agiou Andreou, Efstathiou Court, Flat 201, 3035 Limassol, Cyprus, facilitates services to Tradeco Limited, including but not limited to payment services.

Tradeco Limited is authorised and regulated by the Seychelles Financial Services Authority with licence number SD029.

Risk Warning:

Our products are traded on margin and carry a high level of risk and it is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved.

T4Trade is not targeted to residents of the EU where it is not licensed. T4Trade does not offer its services to residents of certain jurisdictions such as USA, Iran, Cuba, Sudan, Syria and North Korea.

Legal Documents

Thank you for visiting T4Trade

This website is not directed at EU residents and falls outside the European and MiFID II regulatory framework.

Please click below if you wish to continue to T4Trade anyway.

Thank you for visiting T4Trade

This website is not directed at UK residents and falls outside the European and MiFID II regulatory framework, as well as the rules, guidance and protections set out in the UK Financial Conduct Authority Handbook.

Please click below if you wish to continue to T4Trade anyway.